One Firm, One Focus, One Investment Approach

Every decision we make is in pursuit of a single objective: investments in growth businesses with durable competitive advantages, run by great teams. This single approach has driven consistent performance for over 40 years.

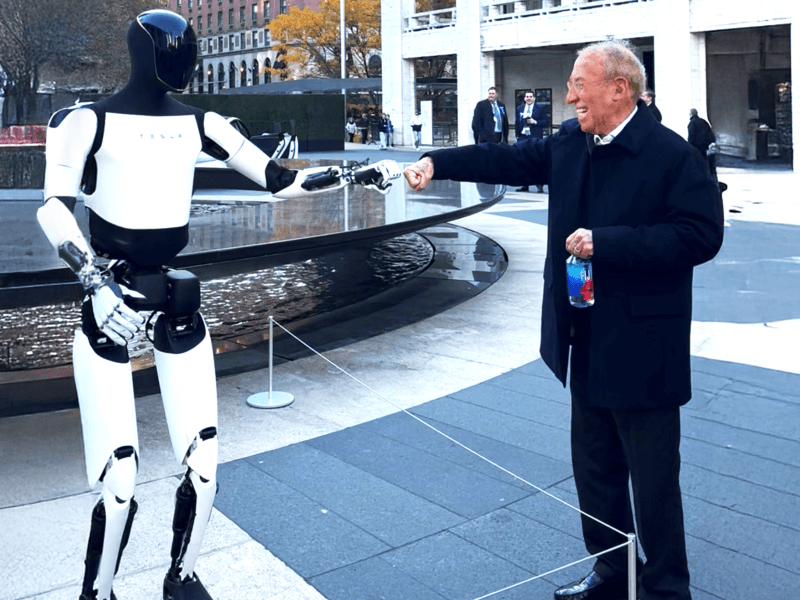

Portfolio Holding | Tesla, Inc.

Long-Term Investors in a Short-Term World

Being a long-term investor means we think about our investments as business owners. We have no particular views on the near-term course of interest rates, inflation, markets, or the overall economy. History shows most that have were wrong anyway. Instead, we are laser-focused on each company’s business fundamentals and our vision of what a business could become.

Our Investment Approach

At Baron Capital, our entire organization is united in a single investment style and objective. We are long-term investors in secular growth businesses with durable competitive advantages that are run by great management teams.

Idea Generation

Baron Capital portfolio managers and research analysts are our single most important source of idea generation. With our roots in research, we have developed deep industry expertise and are knowledgeable about the companies in the industries we cover.

Research

The goal of our research process is to identify and monitor investments that we believe will deliver above-average, long-term, and risk-adjusted results.

Portfolio Construction

Every Baron Capital portfolio is built from the bottom up, stock by stock, based on our conviction about the future growth prospects of each business.

Risk Management

We have a deeply embedded risk management culture. We view risk as the probability of an adverse outcome leading to permanent loss of capital.

Baron's Investment Algorithm

At Baron Capital, our MISSION is to Change Lives by creating wealth for clients and our fellow employees and their families. Our investment algorithm defines who we are…how we invest…and the culture we’ve built over decades of disciplined growth investing.

We believe people are our most consequential investment. We invest in the people of Baron Capital who shape our culture; the visionary leaders of our portfolio companies; and our clients who entrust us with their capital. Strong relationships and shared commitment are the foundation of long-term success.

We are patient investors with a long-term mindset. We invest in businesses that we believe can double in value over the next 5-7 years. Unlike most asset managers, as a result of our proprietary research, we are prepared to weather market volatility, knowing that true value creation requires time.

We challenge conventional wisdom and take nothing for granted. Our research-driven investment process is built on asking hard questions and uncovering insights others overlook. Our insatiable curiosity allows us to identify long-term opportunities with confidence, and more importantly, leaders we TRUST.

We approach investing with optimism and an open mind. Innovation and progress often come from unexpected places, and we are willing to take bold positions when we see the potential for extraordinary outcomes. Our belief that “Anything is Possible” drives us to uncover unique opportunities and back visionary leaders.

We believe that to outpace inflation and generate meaningful long-term wealth, you need to OWN assets that appreciate over time...even faster than what we believe is the long term 4-5% historic inflation rate. We invest like business owners — focusing on companies with durable competitive advantages, strong leadership, and the potential for sustainable growth.

We are stewards of both our clients’ capital and our family business. Just as we manage Baron Capital with a long-term vision, our MISSION is to “change lives” of our clients and fellow employees and help them build lasting legacies. Our disciplined approach and unwavering commitment to our principles guide us in creating generational value.

These principles are the foundation of our success and the reason we’ve been able to create exceptional long-term value for our clients and employees for over 43 years.

News & Insights

Thoughts from Our Investment Team

"What we're trying to do is the old-fashioned, fundamental research - getting to know quality management teams at quality growth companies that we think have competitive advantages in the market and have big markets to exploit where there's not a lot of penetration."

The Role of ESG

ESG Integration Into Our Research Process¹

The assessment of ESG principles is a natural part of the Baron Capital research process and investment approach. We have long sought to find growth companies with sustainable competitive advantages, and we recognize the importance ESG factors and risks play in the long-term success that we seek.

We believe that well managed companies are run by great people who seek to minimize risks and maximize their ability to capitalize on growth opportunities, while being good stewards of capital, good corporate citizens, and benefiting all stakeholders.

¹ Impact investing and/or Environmental, Social and Governance (ESG) managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG strategies may rely on certain values based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating.

Portfolio holdings as a percentage of net assets as of December 31, 2025 for securities mentioned are as follows: Tesla, Inc. - Baron Fifth Avenue Growth Fund (4.2%), Baron Focused Growth Fund (8.1%), Baron Global Opportunity Fund (1.7%), Baron Opportunity Fund (6.0%), Baron Partners Fund (26.7%*), Baron Technology ETF (5.6%), Baron First Principles ETF (10.3%).

*% of Long Positions

Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk.