Letter from Ron | Q3 2024

Letter from Ron

October 7, 2024 | Download PDF

“Two all-beef patties, special sauce, lettuce, cheese, pickles, onions, on a sesame seed bun...” McDonald’s Big Mac jingle 1974 commercial.

In 1968, McDonald’s added the “upscale” Big Mac hamburger sandwich to its menu. The average selling price for a Big Mac was then 49 cents. I believed the value McDonald’s provided to middle class Americans with 15 cent burgers...12 cent French fries...12 cent Cokes...and 15 cent apple pie desserts was exceptional. McDonald’s was one of my two favorite “restaurants” in Washington, D.C. The other? Luigi’s Pizza. Whenever I visited Washington in the early 1970s and exited Union Station, I never failed to stop for a Big Mac. Big Mac’s average price is now over $5.00! This tenfold price increase represents 3 1/4 “doubles” over the past 56 years....a price increase of 4.25% per year!

...which obviously shows 4% to 5% annual inflation is not unusual in America. On average, the buying power of our currency falls in half about every 14 to 15 years This is because our government spends more than it takes in, depreciating the value of the dollar 4% to 5% annually to pay for wars...to recover from pandemics...to pay for social services and to manage our economy. The United States’ economic model works. With just 4% of Planet Earth’s population, the United States’ share of our planet’s GDP approximates 25%!

Persistent inflation has been present in America during my entire lifetime not just since COVID-19 the following stories are also illustrative...

When I became an analyst in 1970, McDonald’s was one of my most successful early investment recommendations. In large part because I thought McDonald’s growth opportunity was enormous...its restaurant unit economics were unusually favorable I really liked its franchise model, where lots of restaurants were built on land owned by the parent company...it had plenty of pricing opportunity and Founder Ray Kroc was maniacal about keeping his bathrooms spotless! But, I’m getting ahead of my story...

In the summer of ‘69, on my 26th birthday, I had “aged out” of the Vietnam War draft. Two days later, I resigned from my draft exempt, “critical skills” position as a United States Patent Examiner. My “critical skill” was chemistry, my undergraduate major at Bucknell. The United States Patent Office (“USPO”) believed my chemistry knowledge would translate into expert analysis of non-obvious, chemical coating “inventions.” In an amazing coincidence, I studied and issued patents for coatings on rocket nose cones that would prevent them from burning up upon reentry. So, surprisingly, I began studying SpaceX investment fundamentals more than 50 years ago! My starting examiner salary in 1966 was $7,729 per year. Four years later, it had increased to $12,000. ($120,000 in present day dollars). Examiners received annual raises whether or not they performed well.

I was not a great Patent Examiner. At my farewell luncheon, my supervisor, Morris Liebman, compared me to a famous Patent Examiner in Switzerland from 1902 to 1907. The young Swiss patent examiner all those years ago, Mr. Liebman told us, was “just like ‘Rod.’ He also didn’t like being a Patent Examiner. That examiner developed the groundbreaking special theory of relativity in his spare time! ‘Rod’ was also not an awesome Patent Examiner...because he spent more time learning about investments than coatings...but we should expect to read a lot about him in coming years on Wall Street,” Mr. Liebman continued. I was such a memorable examiner that after having worked in the USPO for almost four years, Mr. Liebman still thought my name was “Rod” not “Ron!” I stopped correcting him after about a year.

When I left the USPO that May, I also dropped out of George Washington University Law School. I had attended law school in the evenings on a partial scholarship for seven semesters....but since I no longer had my Patent Examiner salary and did not want to be a lawyer, I left Law School one semester short of graduation....$15,000 in debt ($150,000 in current day dollars)...without a law degree. In a U-Haul truck with my motorcycle, shaggy hair, Fu Manchu mustache and all my worldly belongings, I headed to Wall Street and an analyst career.

For three months after I arrived in New York City, I was unemployed and lived in a high school friend’s basement in Maplewood, New Jersey. I slept on a cot on a green shag rug next to a water heater...and ran errands for my friend’s wife on weekends to “pay” for room and board. On weekdays I knocked on doors of Wall Street banks and headhunters seeking an analyst job. While I refused to give up, after three months it was obvious how hard it was going to be to convince anyone to take a chance on me. David Schneider, our senior trader who has worked with me since 1987, recently saw a picture of me in 1970. His comment? “How did you ever convince anyone to hire you?” But, Anything Is Possible. When Janney Montgomery Scott (“Janney”) hired me as an analyst, I was ecstatic. My initial annual salary was $15,000 per year ($150,000 in present day dollars) with a promised 20% raise after a year. I didn’t receive that raise because I was fired in less than a year. That was because I recommended the sale of General Development Corporation (“GDC”), an Orlando-based retail land sales business. I believed GDC had insufficiently reserved to build contracted infrastructure. Inadequate reserves were the result of inflation due to the Vietnam War...and President Johnson’s “Guns and Butter” fiscal policies. I was right. GDC shares began to fall after my report was published. Ultimately from $34 per share to zero. I was fired because Janney was a member of a syndicate raising money for GDC to fund infrastructure and had to leave the syndicate because of my report.

One more thing. I liked McDonald’s so much that I named my Cocker Spaniel puppy Big Mac, or “Mackie” for short. When I moved to Manhattan in 1973, I lived in the same building as two young children, Dana and Wendy Telsey, who referred to me as the “Cocker Spaniel” man. The two young girls walked my dog with me nearly every morning before school for them and work for me. When Dana was a college sophomore, I met her and her mom on the street when I was starting Baron Capital. Since I believe “what goes around, comes around,” when her mom asked me to consider Dana as my assistant, I hired her when she graduated. Dana...not her mom. Dana worked for me for eight years, organizing research projects and attending my management research meetings where she took copious notes. Her then boyfriend, Leigh, who is now her husband, reviewed her daily notes every night and asked Dana, “Why do you think Ron asked that question?” ...and “What do you think he was trying to learn?” In the late 1980s, it had become obvious to others how talented Dana was. She was then recruited away from me and offered opportunities at the time I couldn’t afford to match. Dana, with her Telsey Advisory Group expertise in retail businesses, is one of two very successful individuals who have left Baron. Not many analysts have left, of course, but I congratulate her. She’s still my friend and deserves great credit for her hard work, achievements, and learning what “Question Everything,” one of the pillars of Baron Capital Group, means.

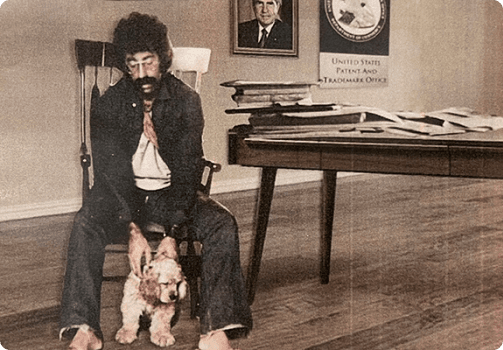

Photo Caption: Ron Circa 1976

When it was just me and Big Mac, my cocker spaniel–named after the only restaurant I could afford and one of my first successful investment recommendations! Not sure who was shaggier!

“How do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions?” Alan Greenspan. Chairman. Federal Reserve. Dow Jones Industrial Average. 6437. December 5, 1996.

Chairman Greenspan was criticized at the time for his “irrational exuberance” phraseology...but, he wasn’t wrong. Over the long term, stock prices of publicly traded businesses we own are inextricably tethered to their fundamental prospects and to the growth of America’s economy. However, while America’s economy has consistently grown in the mid-single digits annually, markets and share prices often vacillate between extravagantly high valuations and more modest appraisals. These fluctuations occur despite common stocks and equity mutual funds providing the most attractive long-term returns for most of us. Elon Musk analogizes share price fluctuations to an individual standing on your front lawn and shouting out a new price for your home every fifteen minutes...when nothing to justify different valuations has taken place!

Chairman Greenspan’s “irrational exuberance” remarks in 1996 were made after six years of remarkable annual returns in the mid-teens for U.S. stocks. Those exceptional returns diverged significantly from the steady mid-single-digit annual growth rate of America’s GDP. Stock returns much higher than America’s economic growth from 1990 through 1996 resulted from excitement over the latest, greatest technological innovation...the Internet.

The four years following Chairman Greenspan’s comments experienced similar extraordinary mid-double-digit annual growth rates for stocks... and mid-single-digit annual growth rate for America’s GDP. Strong stock market appreciation persisted until 2000, the year “the Internet bubble burst.”

For the following 8 years through The Great Financial Crisis (“GFC”) in 2008, stock prices fell on average 2.1% per year. Interestingly, although passive stock indexes fell during those years, America’s economy continued to steadily expand...averaging nearly 5% per year from 2000-2008! Finally, during the 16 years from the GFC through 2024, stocks again significantly outperformed America’s economy.

GDP | CAGR | Stocks | CAGR | |||||

|---|---|---|---|---|---|---|---|---|

| 1990-1996 | 35% | 5.2% |

| 74% |

| 9.7% | ||

| 1996-2000 | 29% | 6.5% |

| 148% |

| 24.0% | ||

| 2000-2008 | 47% | 4.9% |

| (15.7%) |

| (2.1%) | ||

| 2008-2024 | 97% | 4.1% |

| 324% |

| 9.3% | ||

| 1996-2024 | 273% | 4.7% |

| 836% |

| 8.1% | ||

Most importantly, if you had invested in December 2000 in a low cost, passive index fund before the Internet Bubble burst, the worst possible timing in the past 24 years to initiate such a strategy, your investment would now be worth about 4.7X your cost! Which clearly validates a “buy and hold” investment strategy...not one reliant upon tactical trading.

New York Jets’ quarterback “Broadway Joe” Namath remarked in 1969, “If you’ve got it, flaunt it.” So...while stock market indexes have outperformed both America’s GDP growth and inflation, since their respective inceptions, 15 of 19 Baron mutual funds, representing 96.7% of Baron Funds’ AUM, have done even better...and outperformed their primary benchmarks!

Thirteen Funds, representing 95.6% of Baron Funds’ AUM, rank in the top 20% of their respective Morningstar categories. Eight Funds, representing 54.9% of Baron Funds’ AUM, rank in the top 5% of their categories.

Baron Partners Fund is the number one performing U.S. equity fund (out of 2,030 share classes) since its conversion in 2003 from a partnership to a mutual fund.* $10,000 hypothetically invested in its passive benchmark index in 1992 when Baron Partners Fund began is now worth approximately $230,000. In contrast, $10,000 hypothetically invested in Baron Partners Fund in 1992 is now worth roughly $949,000. Bloomberg recently reported that Baron Partners Fund is the only U.S. mutual fund to outperform Invesco’s QQQ index ETF.

If instead of investing in a passive index, you had hypothetically invested in small-cap growth Baron Growth Fund at its inception in 1994, your investment would have increased in value 35 times, compared with an increase of 9 times for a hypothetical investment in the Fund’s primary benchmark...if in smid-cap Baron Focused Growth Fund, at its inception as a partnership in 1996, the increase would be almost 35 times vs. an increase of 9 times for that Fund’s benchmark...and if in all-cap growth Baron Partners Fund, at its inception as a partnership in 1992, the increase would be 93 times vs. an increase of 22 times for that Fund’s benchmark! The lesson? “Time...time...time is on my side...yes it is” is how Mick Jagger and The Rolling Stones phrased it in 1964. We agree.

Further, just like the Internet changed the calculus of growth investing over a quarter century ago we think technology advances like digitization...cloud...mobility... electrification of transportation...autonomous driving...AI satellite broadband and robotics with impact that is not yet visible will cause the U.S. economy to soon expand more rapidly. In addition, publicly owned businesses have become significantly more capital efficient which makes those businesses more valuable.

Baron Capital Group presently has more than $43 billion assets under management. We have earned more than $47 billion in realized and unrealized profits since 1992 when we managed $100 million! Regardless, for anyone not interested in investing like my family and me in Baron Funds, I recommend investments in passive index funds. That is since few “active investors” like us earn more than passive index returns. Baron mutual funds are some of the top performing mutual funds in the U.S., since their respective inceptions.

Baron Capital Co-Presidents David and Michael Baron with Rachel Stern, the Firm’s recently appointed COO, share optimistic insights...and a few laughs... at October Firm wide town hall.

“Building Legacy” is the theme of the 31st Annual Baron Investment Conference. November 15, 2024. Metropolitan Opera House. Lincoln Center. New York City.

The “Building Legacy” theme of Baron’s 31st Annual Conference is intended to describe foundational values of our Firm that have enabled us to achieve exceptional returns...for you... for ourselves... and for our families. Those are the “what we do?” ...and...“how we do it?” segments of our program. Of course, leavened with humor.

We also intend to outline the Mission of our business...the “why” are we doing this? Included among the pillars of our Firm’s investment process are elements we hope will give you confidence in how we conduct our family business...and that the extraordinary returns we have achieved...will likely continue as far as the eye can see... Although we can obviously not promise returns in the future will be as good or better than in the past...we can promise that we will try as hard as we can to make sure that is the case.

“We Invest in People” “Question Everything” “Exceptional Takes Time” “Anything is Possible” “OWN IT!” “Growth + Values” are the pillars of our business...and among my favorite themes of past Baron Annual Conferences. And now, “Building Legacy.” All we have to do is continue to execute.

One of my favorite people likes to say it is irrational to “not sell” investments after making strong returns. It’s especially hard to “not sell” when everyone is watching, but that’s how we have earned the best returns.

According to studies by Fidelity and Charles Schwab, two outstanding investment firms I admire, “traders” who buy/sell the most have the worst results. According to Morninstar’s John Rekenthaler, a study of a highly respected large investment firms’ accounts found that those with the best returns were “either dead or inactive!” Not sure if this is a true or apocryphal story. But it sounds right. Another? “Women generally beat men.” That is since women trade 45% less!

Wall Street has a legendary ability to develop products that generate activity and commissions. ETFs. Options. Swaps. Futures. Forwards. Single stock options. Daily single stock options! Risk parity. Derivative hedges. I used to always ask brokerage firms about how successful their customers were. I never got a good answer. The “house” always did great though.

Oh yeah. I’d be remiss if I didn’t mention that in addition to our published program of CEOs/ COOs of Arch Capital Group Ltd., MSCI Inc., Red Rock Resorts, Inc., and Space Exploration Technologies Corporation (“SpaceX”)...and amazing entertainment at lunch and end of day...and my speech that I try to make both fun and serious...and door prizes of three Teslas...and incredible Scream Ice Cream cones..and cool FIGS t-shirts..and tips about characteristics of successful businesses...like “adding pennies in value to products every year...not just trying to make products less expensive...” there’s more. There’s always more. This year, a live virtual visit by “Starman”...a man who lives in the future and knows who won all the elections for the next 500 hundred years but promises not to talk about them...and I will discuss “The Future” streamed on X.

Look forward to seeing you in New York on November 15. Going to be a great time. Thank you for joining us as investors in Baron Funds.

Respectfully,

P.S. Last year more than 5,100 investors attended our meeting. Please register early.

Additional Must-See Resources

* This is a hypothetical ranking created by Baron Capital using Morningstar data and is as of 9/30/2024. There were 2,030 share classes in the nine Morningstar Categories mentioned below for the period from 4/30/2003 to 9/30/2024.

Note, the peer group used for this analysis includes all U.S. equity share classes in Morningstar Direct domiciled in the U.S., including obsolete funds, index funds, and ETFs. The individual Morningstar Categories used for this analysis are the Morningstar Large Blend, Large Growth, Large Value, Mid-Cap Blend, Mid-Cap Growth, Mid-Cap Value, Small Blend, Small Growth, and Small Value Categories.

As of 9/30/2024, Morningstar Large Growth Category consisted of 1,141, 1,005, and 788, share classes for the 1-, 5-, and 10-year periods. Morningstar ranked Baron Partners Fund in the 100th, 1st, 1st, and 1st percentiles for the 1-, 5-, 10-year, and since inception periods, respectively. The Fund converted into a mutual fund 4/30/2003, and the category consisted of 708 share classes.